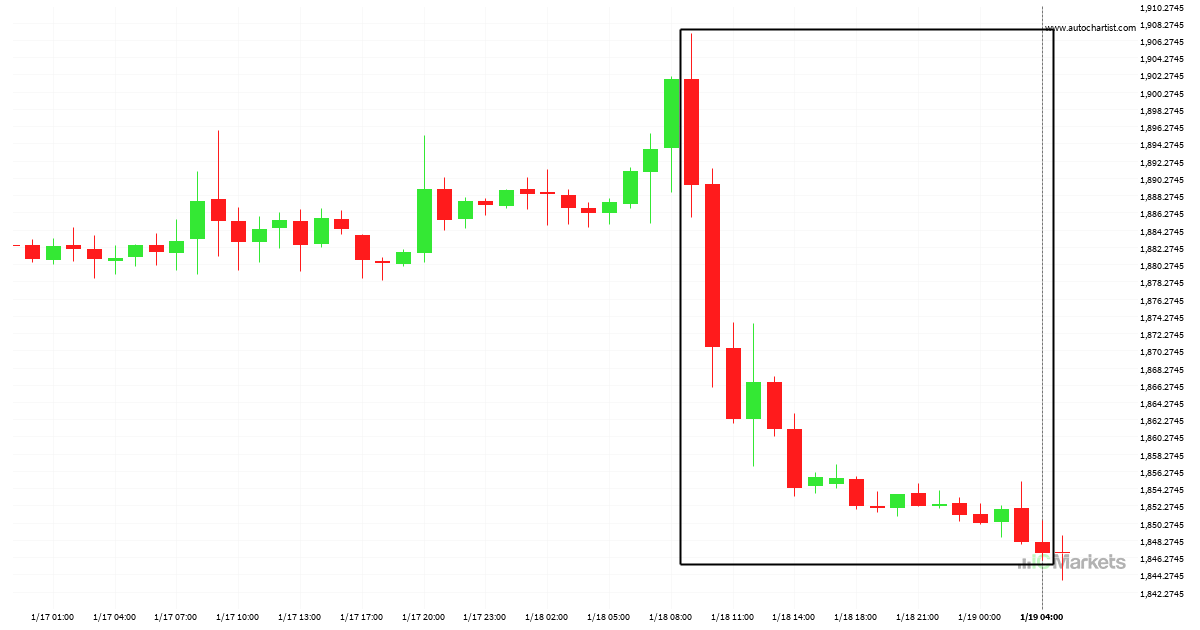

US Small Cap 2000 Index is on its way down

US Small Cap 2000 Index has experienced an exceptionally large movement lower by 2,26% from 1889.5 to 1846.76 in the last 19 hours.

Possible breach of resistance level by US SPX 500 Index

US SPX 500 Index is moving towards a resistance line which it has tested numerous times in the past. We have seen it retrace from this line before, so at this stage it isn’t clear whether it will breach this line or rebound as it did before. If US SPX 500 Index continues in its […]

A final push possible on Microsoft Corporation

Microsoft Corporation is heading towards 240.3550 and could reach this point within the next 17 hours. It has tested this line numerous times in the past, and this time could be no different, ending in a rebound instead of a breakout. If the breakout doesn’t happen, we could see a retracement back down to current […]

Possible breach of resistance level by US SPX 500 Index

US SPX 500 Index is moving towards a resistance line which it has tested numerous times in the past. We have seen it retrace from this line before, so at this stage it isn’t clear whether it will breach this line or rebound as it did before. If US SPX 500 Index continues in its […]

Possibility of big movement expected on Microsoft Corporation

Microsoft Corporation has broken through a resistance line of a Canal descendente and suggests a possible movement to 242.6581 within the next 19 hours. It has tested this line in the past, so one should probably wait for a confirmation of this breakout before taking action. If the breakout doesn’t confirm, we could see a […]

US SPX 500 Index has broken through support

US SPX 500 Index has broken through a support line. It has touched this line at least twice in the last 2 days. This breakout may indicate a potential move to 3952.2705 within the next 5 hours. Because we have seen it retrace from this position in the past, one should wait for confirmation of […]

US Small Cap 2000 Index approaching resistance of a Cunha ascendente

US Small Cap 2000 Index is approaching the resistance line of a Cunha ascendente. It has touched this line numerous times in the last 8 days. If it tests this line again, it should do so in the next 11 hours.

Will US Wall Street 30 Index have enough momentum to break support?

US Wall Street 30 Index is heading towards the support line of a Cunha descendente and could reach this point within the next 6 hours. It has tested this line numerous times in the past, and this time could be no different from the past, ending in a rebound instead of a breakout. If the […]

Coca-Cola Co. – getting close to psychological price line

Coca-Cola Co. is moving towards a resistance line. Because we have seen it retrace from this level in the past, we could see either a break through this line, or a rebound back to current levels. It has touched this line numerous times in the last 25 days and may test it again within the […]

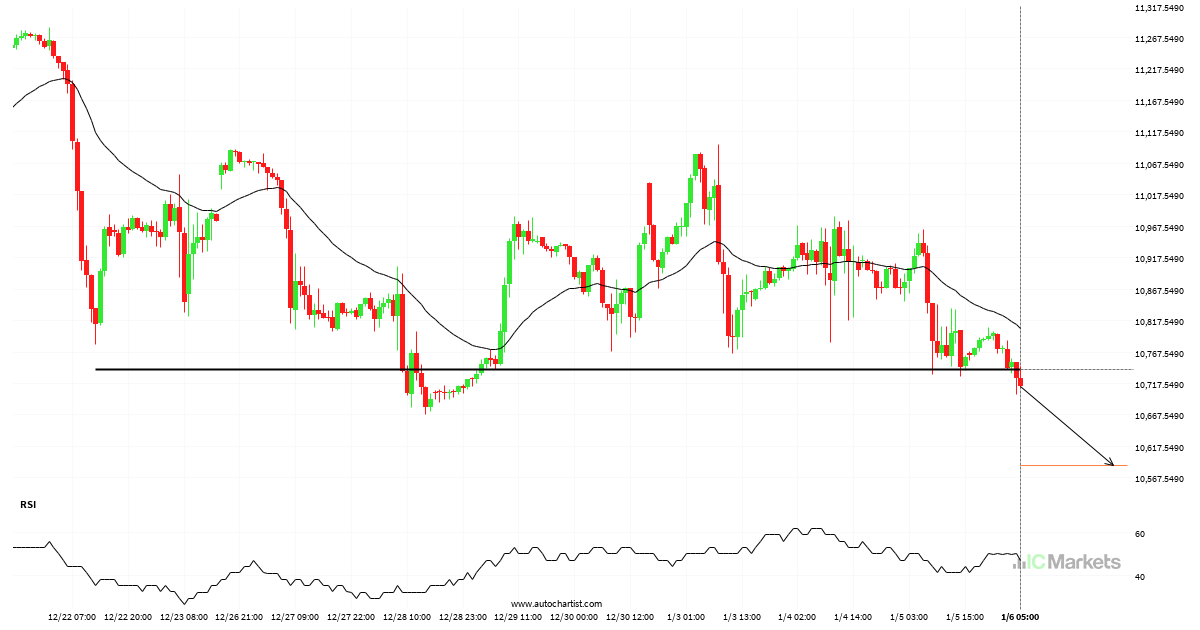

Big movement possible on US Tech 100 Index

US Tech 100 Index has broken through a line of 10740.4004 and suggests a possible movement to 10587.8203 within the next 3 days. It has tested this line numerous times in the past, so one should wait for a confirmation of this breakout before taking any action. If the breakout doesn’t confirm, we could see […]